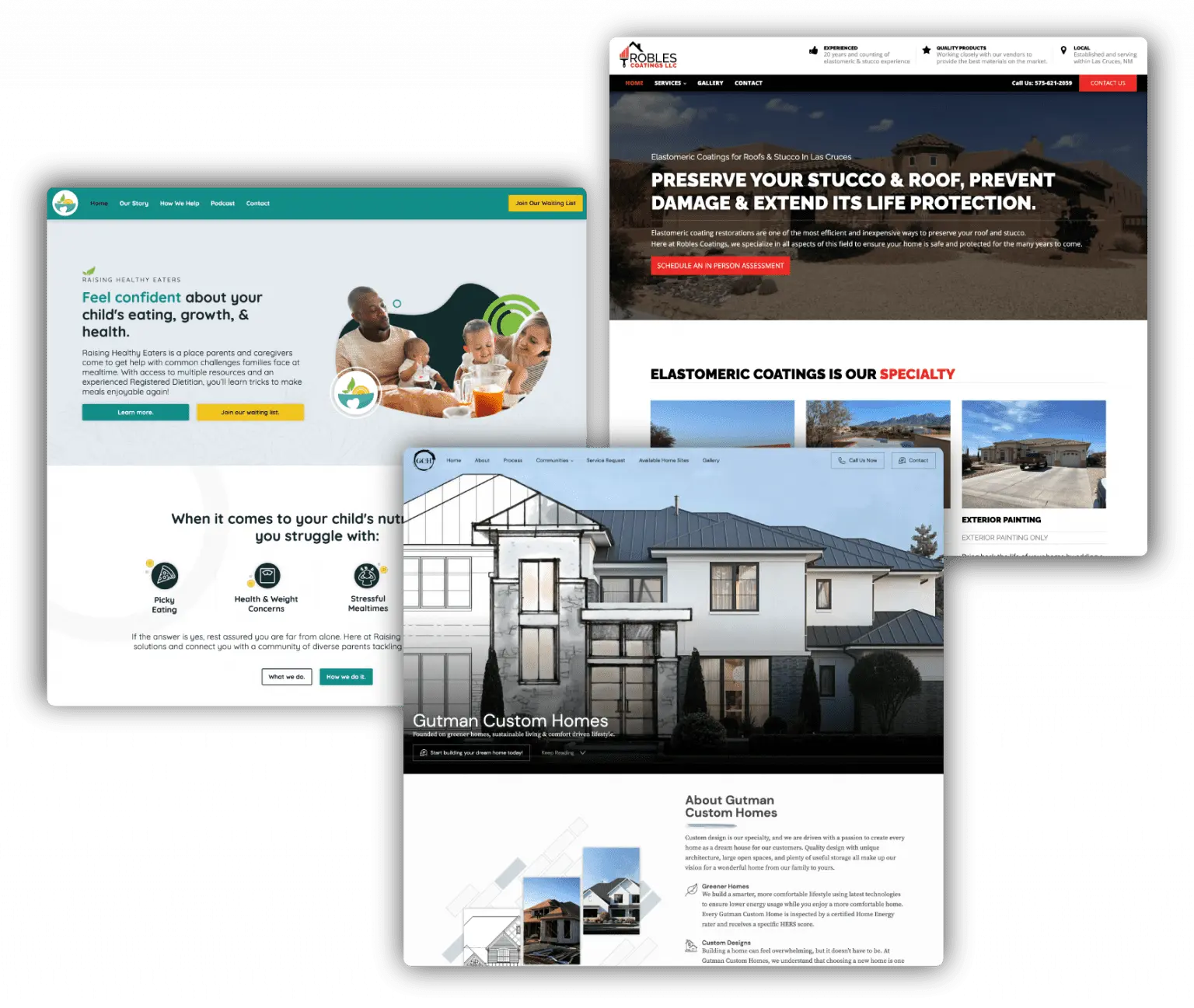

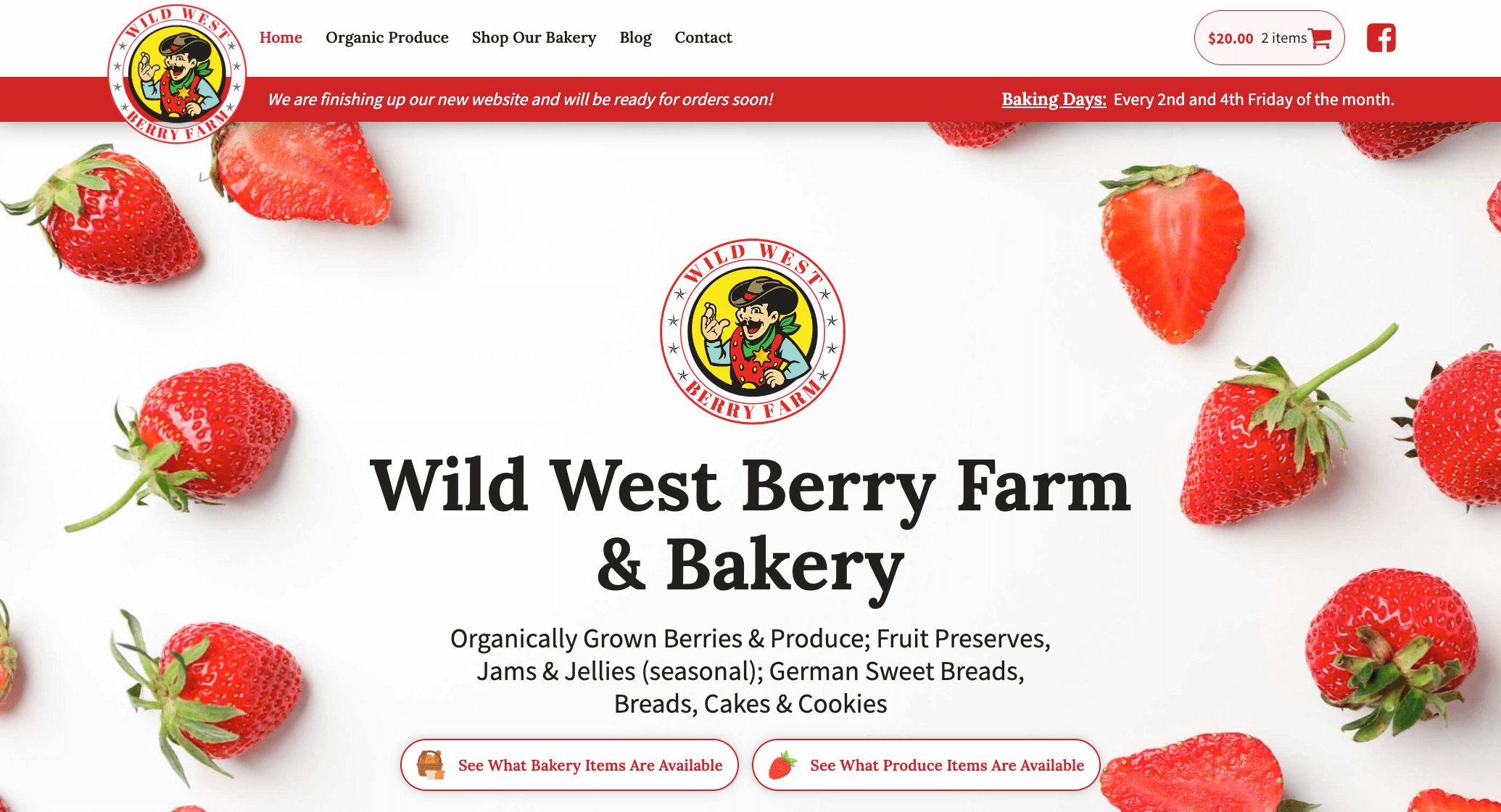

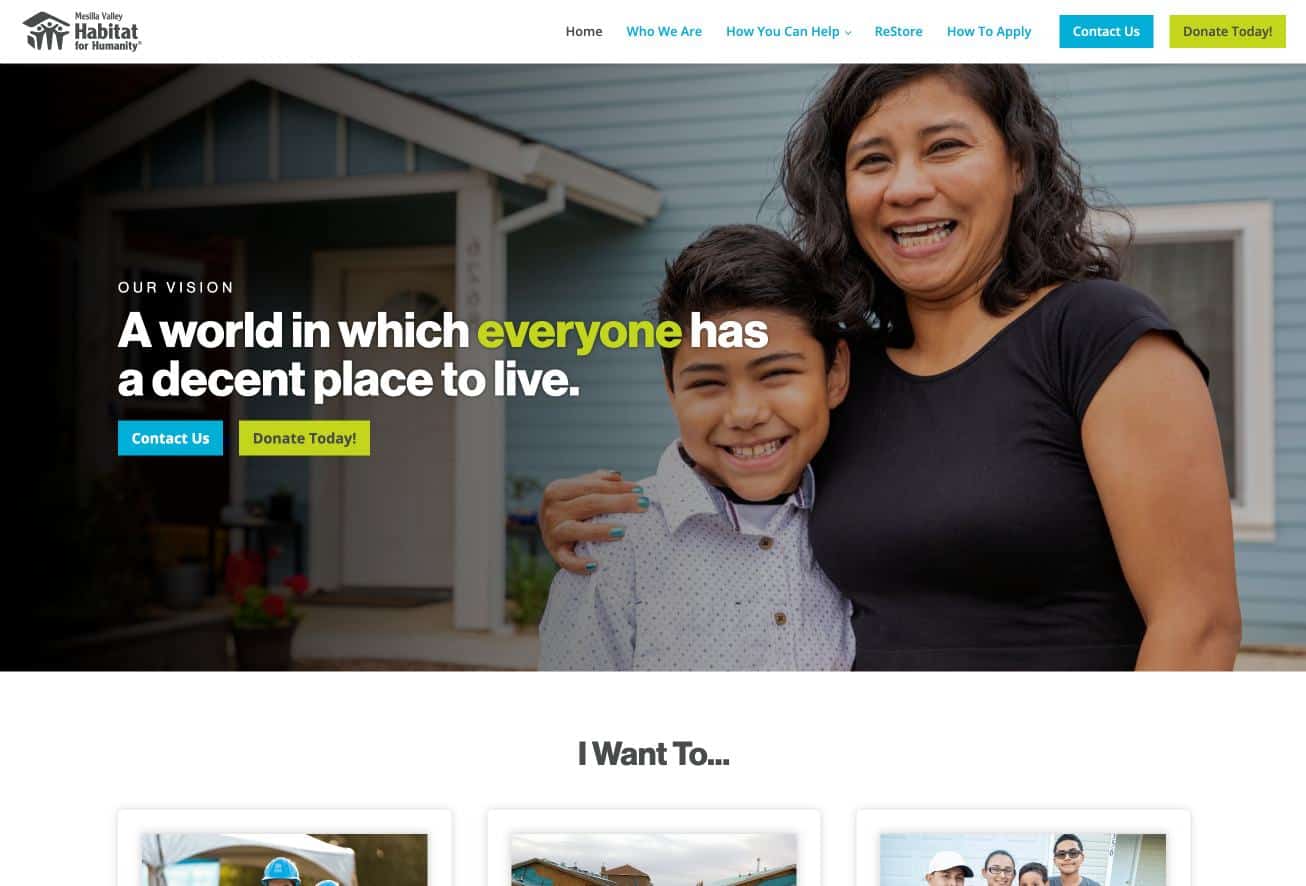

Founded in Las Cruces, New Mexico, SpyderWeb Dev (SWD) specializes in innovative ways to market your business online throughout southern New Mexico and beyond. These services include Web Design, Web Development, Review Generation, and Local SEO services.

Copyright © 2015 – 2024 Copyright SpyderWeb Dev, LLC. All rights reserved.